A large number of Russian goods will be subject to carbon adjustment, which currently amounts to about 70 Euros per 1 ton of carbon footprint. In the future, this will amount to about 1 billion euros of duties to the European budget at the expense of Russian exporters. What should Russian exporters do in this situation? How to reduce your risks and costs?

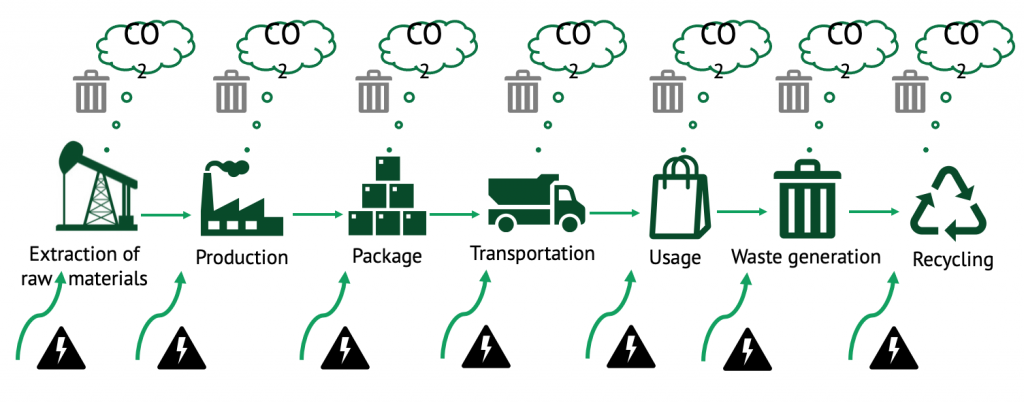

As part of the dialogue at the forum of the Russian week of import and export, HPBS proposed various measures to calculate, optimize and compensate of the carbon footprint of companies and products. Nowadays companies need the understanding of their carbon footprint and the ability to optimize it throughout the entire supply chain, from raw material extraction to finished production.

Europe is implementing the Green Deal project and is gradually reducing greenhouse gas emissions. As a part of this program, cross-border carbon regulation is being introduced. It will apply since 2026 to all exporters who supply products to Europe in order to correct their carbon footprint. Due to the fact that Europe has quite strict legislation on greenhouse gas emissions and the carbon footprint, so they take into account the risk of carbon leakage. That is, for example, manufacturers will simply move their production outside of Europe and, thus, avoid this adjustment.

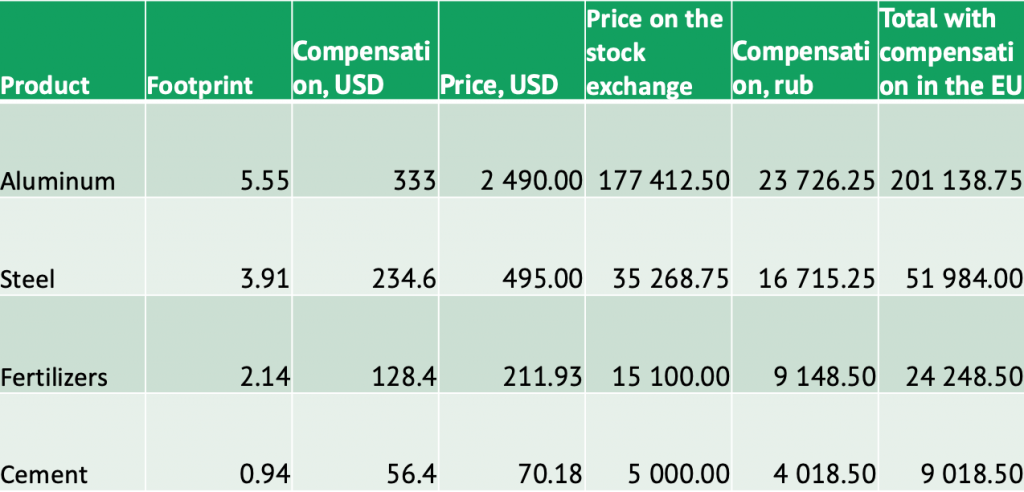

At the first stage, adjustment (compensation) is introduced for the following types of products: steel, cement, fertilizer, aluminum, and gradually the line of these products will be expanding. In addition, this is not only a European trend, it is happening all over the world, and we can say that the eastern countries are also announcing their plans to reduce greenhouse gas emissions, declaring that they will try to achieve carbon neutrality by 2060. Accordingly, now there are countries with and without carbon legislation. Therefore, there is an isolated green market in Europe, with its own carbon prices, with its own carbon certificates and boundaries, which they are trying to adjust with other markets using the CBAM mechanism.

Russian exports, according to KPMG’s calculations, will pay about 1 billion euros in 2026, and about 5 billion euros in 10 years. This calculation is based on current carbon prices. They are haggling on the European stock exchange, prices depend on the needs of the market and their number is quite limited.

At the moment, Russia does not have strict carbon regulation, and compared to Europe, we may seem to be an offshore company in terms of carbon legislation, so at some point in time, it will be more profitable for Russian producers to localize production compared to European ones. But this will not last long, Russia already has a law on reducing greenhouse gas emissions, which was signed in July 2021. However, specific mechanisms and actions have not yet been worked out. There is a redistribution of capital and investments in the world, and accordingly, banks are reluctant to provide funds for the implementation of projects with high carbon intensity. At the same time, the demand for carbon-neutral or green projects is growing strongly. At prices of the European site in million euros as of November 9, 2021, 1 ton of C02 costs 60 euros.

In particular, the adjustment that will operate in the European Union is the carbon footprint accumulated during shipment at the plant. Perhaps there will still be transport to the border.

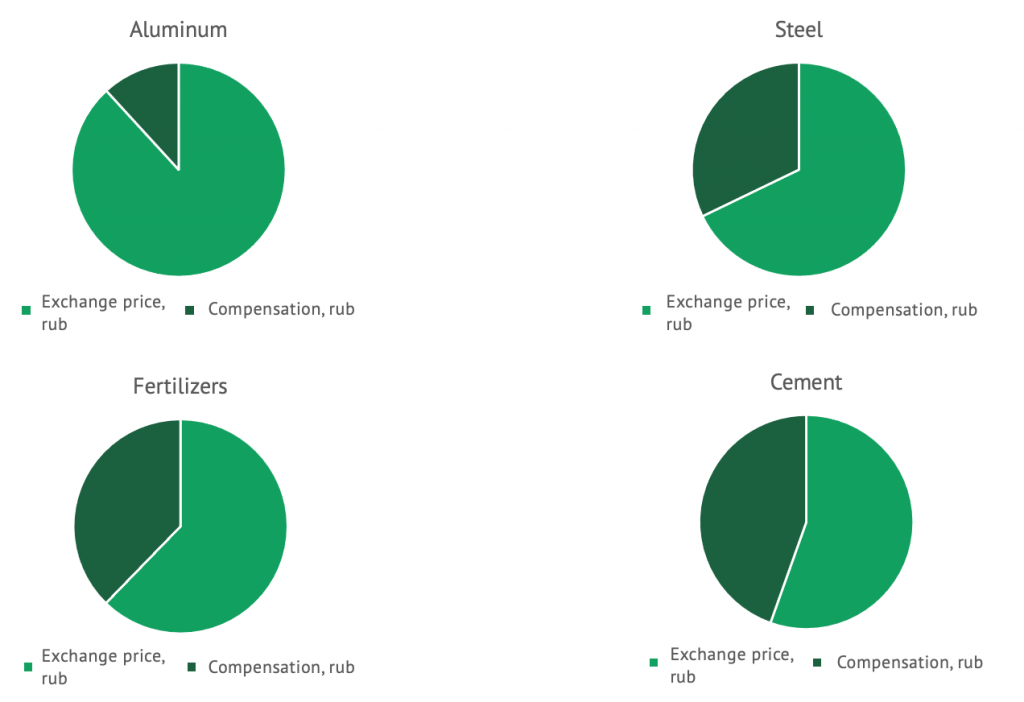

Below the calculation of the carbon adjustment is presented, it is based on the carbon footprint per tonne of product. For fertilizers and cement, compensation has a large share due to low carbon adjustment.

This problem relates to the entire supply chain, production, extraction of raw materials and energy. To optimize the overall carbon footprint, it is necessary to optimize it at all stages of production: choose responsible suppliers, use renewable energy sources, improve production energy efficiency, use recyclable packaging and more optimal transport.

EPD shows ecological and carbon footprint. Based on these calculations it’s possible to reduce carbon adjustment if it’s proved that products have a lower footprint compared to the general industry. EPD provides special conditions for suppliers who have verified their carbon footprint.

EPD is being developed in accordance with the international standard ISO 14025 and taking into account the rules of groups of similar products.