The ESG rating shows the company’s level of preparedness for environmental, social and managerial risks. For investors and clients, it serves as an indicator of the prospects of cooperation with the corporation, as well as the profitability and profitability of potential investments. The standards allow us to assess the level of compliance of projects with modern requirements of a long-term strategy.

Forms requirements for corporate, non-financial reporting in the field of sustainable development. Includes: anti-corruption, water conservation, biodiversity, occupational health and safety, emissions taxes. Allows companies to identify, collect and provide data in the environmental, economic and social spheres. According to the results of compliance with GRI requirements, they fall into the international database of non-financial reporting. This allows government agencies, market participants, investors, analysts and other interested parties to see the main non-financial indicators of the organization, assess its level of transparency, as well as compare the data provided with the declared values. Such accounting makes it possible to take real actions to improve the environmental situation and create social and economic benefits for the whole society.

The Council for Accounting Standards in the Field of Sustainable Development. He has developed 77 industry documents that define a minimum set of financially significant areas of sustainability and related indicators for an organization in a particular industry, based on its contribution to corporate development. Allows market participants to assess the industry’s exposure to risks.

Assessment of portfolios in real estate and infrastructure for the implementation of sustainable development practices. Participants receive a qualitative study of business processes, a comparison with competitors, a roadmap with actions to improve their performance. The communication platform allows you to interact with investors and use GRESB data and analytical tools to monitor assets, interact with businesses and search for potentially profitable investments.

GRESB appeared in 2009 as the Global Real Estate Sustainability Benchmark. The real estate sector has been expanded to infrastructure facilities.

GRESB’s mission is to preserve and increase the value of assets by analyzing real estate and infrastructure projects for implemented ESG practices:

GRESB Evaluation Participants and evaluation reasons

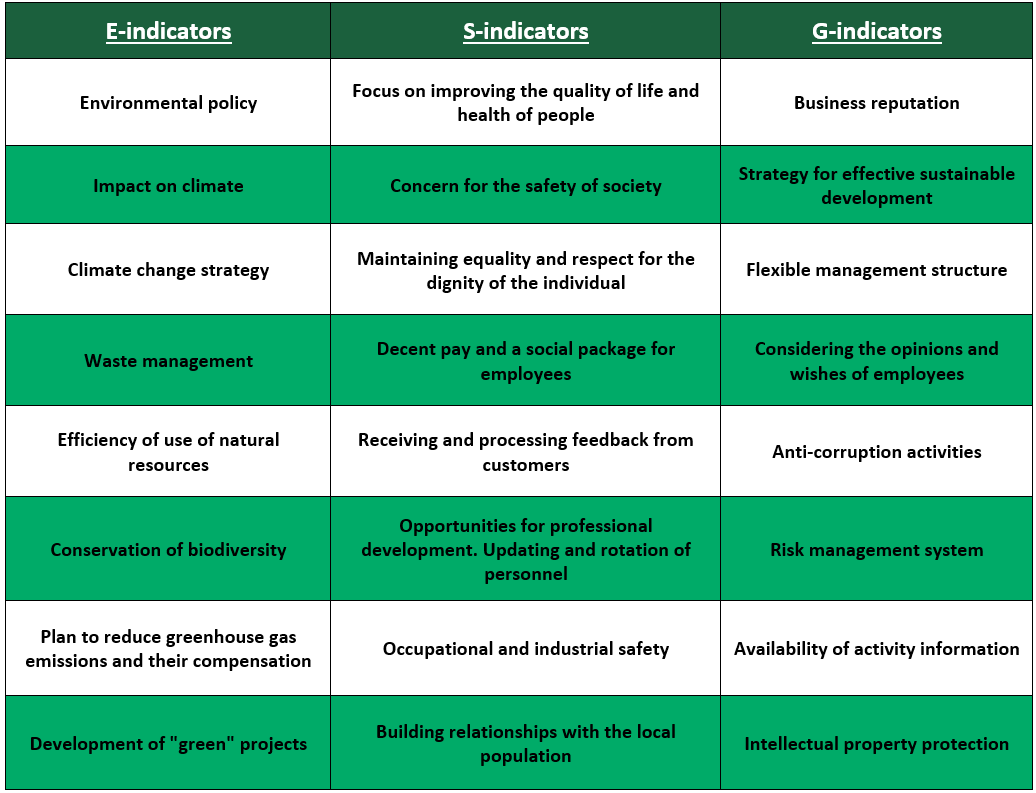

GRESB evaluates performance indicators in terms of environmental, social and managerial components, providing business intelligence tools.

For investors:

For companies, funds and assets: efficiency of facilities and investment portfolios.

The result is an analysis of the use of the best practices of environmental, social and managerial components.

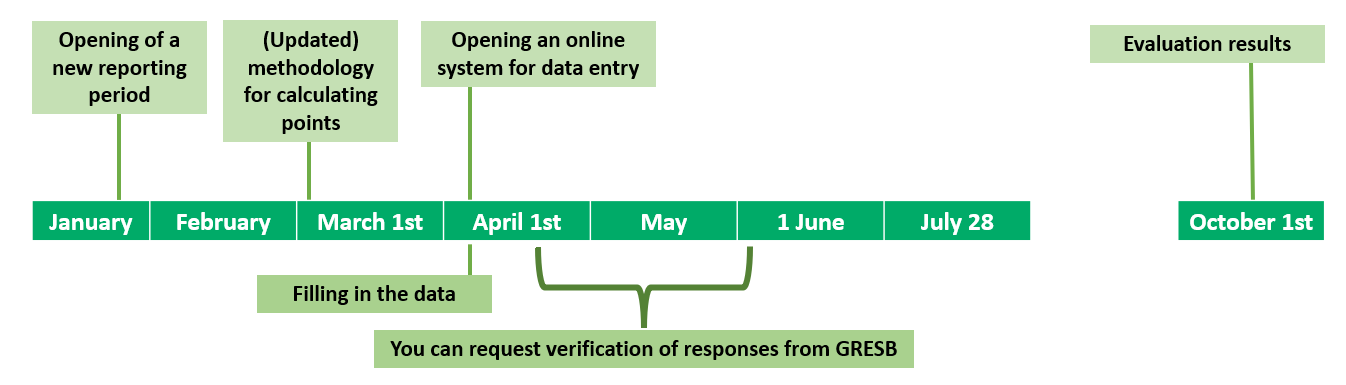

GRESB Deadlines 2022 – by July 1 of this year, you must fill out a questionnaire and submit it for verification for consideration.

Forms reporting requirements for investors, companies, and cities to manage their carbon footprint. An environmental impact disclosure system for solving environmental problems. The goal is to create a green economy by measuring and understanding the impact of business on the environment.

CDP is an international non-profit organization founded in 2000, based in the UK, which supports businesses and cities in data disclosure.

Evaluation participants:

As a result of the evaluation of companies, a rating is awarded and reports are disclosed on the CDP website:

A -, A – market leader in addressing climate change challenges;

B -, B – level of climate risk and opportunity management;

C -, C – the level of awareness of setting climate goals;

D -, D – level of information disclosure “Fact for today”;

F – does not provide the required level of information disclosure;

Not available – The rating is closed by the decision of the company.

CDP Advantages:

Reporting for 2022:

Timeline for 2022:

By July 28 of the current year, it is necessary to fill in all the data of the reporting company.

Subsidized participation (for emerging companies/markets):

Standard participation:

Extended participation:

CDP Rating Improvement: awareness of climate risks -> taking measures to reduce the impact of risks -> planning to reduce emissions.

Provides recommendations for reporting on carbon-intensive assets. TCFD has developed 11 recommendations in four areas: corporate governance, strategy, risk management, metrics and targets. To increase the efficiency of disclosure of environmental impact data for the purpose of deliberate investment, lending and business insurance. TCFD’s recommendations on climate-related financial disclosure are widely applicable to various sectors and jurisdictions. They are designed to collect forward-looking information useful for decision-making, which can be included in the main financial documents.

Helping achieve high-quality disclosure that will allow users to understand the impact of climate change, TCFD recommends that organizations consider seven principles that should be: