The problems of climate change, environmental conservation, reduction of resource consumption and cost reduction within the framework of operational activities are facing both individuals and organizations and States. Each country has its own path of development – there are countries where measures to reduce environmental impact, reasonable consumption and the development of sustainable development Goals have been implemented for decades. Such countries include European states where natural resources are limited, territories are not large. And actively developing countries such as China and Japan are creating sustainable development policies at the level of government and cities, setting aggressive goals to reduce carbon dioxide emissions, waste treatment, and digitalization of urban infrastructure.

This study presents examples of activities implemented within the framework of achieving the Sustainable Development Goals in different countries. The main objective of the study is to show examples of government incentives in the implementation of sustainable development goals. The information contained in the study does not reflect a comprehensive list of activities carried out in the countries selected for the study in terms of implementing the principles of sustainable development, reducing resource consumption and protecting the environment, but shows significant examples.

The authors of the study:

The US federal government is the largest consumer of energy in the country, with over 350,000 energy-consuming buildings and 600,000 vehicles. Energy used in buildings and facilities accounts for about 38% of the federal government’s total energy use, and vehicle and equipment energy use accounts for 62%. Much attention is paid to reducing the energy consumption of state facilities.

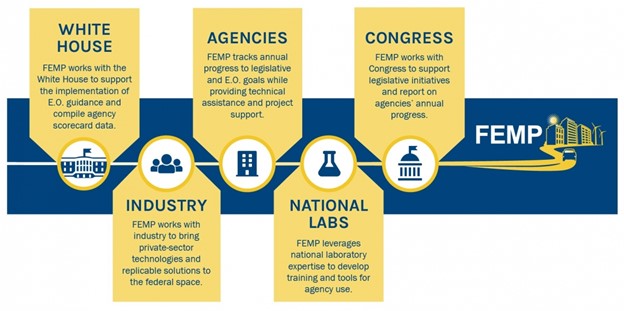

There is a Federal Energy Management Program (FEMP). FEMP takes into account the interests of various stakeholders, with the main goal of achieving energy and water savings in the federal government.

The following are involved in the implementation of the program:

Source: https://www.energy.gov/eere/femp/about-federal-energy-management-program-0

This program has enabled the federal government to achieve a 49 percent reduction in energy intensity since 1975 and savings of approximately $50 billion.

Source: https://www.energy.gov/eere/femp/about-federal-energy-management-program-0

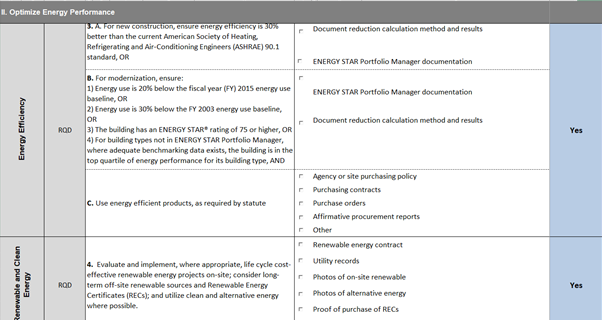

The Federal Energy Management Program has developed a 2016 Guideline Checklist for New Construction and Retrofits and a 2016 Guideline Checklist for Existing Buildings. These checklists can be used to evaluate the performance of the targets defined in the Guidelines for Sustainable Federal Buildings.

Source: Clipping from the 2016 New Construction Checklist.

The principles are mandatory for government facilities and were officially released by the White House Environmental Quality Council in February 2016 (Order No. 13693).

On May 17, 2018, US Presidential Order No. 13834 “Effective Federal Procedures” was signed. The purpose of this order is to organize management procedures in accordance with the best practices of sustainable development, improve the energy efficiency of buildings, optimize the consumption of materials and reduce the environmental impact of the construction of buildings and their operation.

The order includes the following sections:

See https://www.sustainability.gov/resources-eo-efo.html for detailed requirements and links to regulatory documents for each section.

Under Executive Order 13834, Efficient Federal Operations, federal agencies must:

Compliance is achieved through adherence to the Guiding Principles. The guidelines apply to federal buildings over 5,000 square feet. For existing buildings, compliance with the principles for 15% of properties by 2025 is to be achieved, after which a plan is developed to achieve 100%.

Information resources and regulatory guidance required to comply with Order 13834 are available at the U.S. Federal Government Environmental Information Support Site for Government Facilities and Agencies https://www.fedcenter.gov/programs/sustainability/#reg.

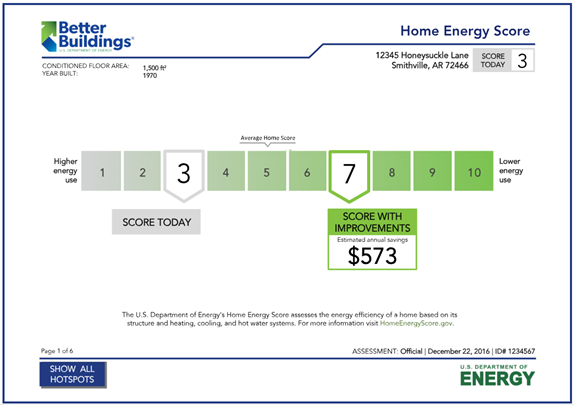

In 2012, the US Department of Energy released a national home energy efficiency rating. More than 90,000 houses have already been evaluated on it.

Score by Score Home Energy shows the energy efficiency of the house, calculated on the basis of the characteristics of the building structure, building envelope, heating, cooling and hot water systems. The assessment results provide detailed information about the current structure and systems, and recommendations on how to improve the energy efficiency of the home in order to achieve a higher score and save money.

Source: https://betterbuildingssolutioncenter.energy.gov/home-energy-score/home-energy-score-about-score

Detailed recommendations are presented by section (insulation, heating, cooling, household appliances, water heating, windows, doors, passive design elements, etc.). They provide an opportunity to analyze the savings obtained by implementing certain solutions.

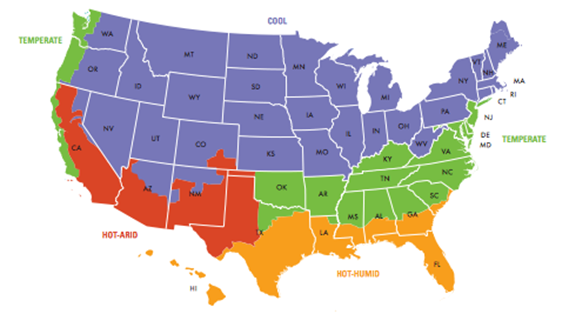

Climate zones are taken into account when developing energy-efficient and landscaping solutions.

Source: https://www.energy.gov/energysaver/design/landscaping-energy-efficient-homes

GSA – General Services Administration provides information on state environmental programs. The policies and guidelines provided in these programs help you comply with environmental laws and regulations, minimize environmental risks, and apply best practices to support environmental principles. GSA has developed and maintains an online resource, https://sftool.gov/, to help federal agencies and the general public build greener facilities and organize green purchases. The site provides extensive information on the subject of sustainable development and green building in various sections, for example, the Energy and Atmosphere section presents: research and statistics on the energy consumption of buildings, recommendations for optimizing energy consumption, information about a non-profit organization that creates quality standards indoor air quality, thermal comfort and energy efficiency, links to federal regulations related to energy efficiency requirements, descriptions of engineering equipment acceptance procedures, key subject terms and definitions, equipment certification programs.

Source: https://sftool.gov/explore/green-building/section/30/ieq/system-overview

As a special case of the implementation of the principles of sustainable development at the state level, the areas of work of the Office of the Administration of the United States of America are presented below in more detail (https://www.gsa.gov/real-estate/environmental-programs-overview).

They include:

– Mandatory repair of structures where there has been a violation of asbestos-containing elements,

– Compliance with the rules and compliance with the requirements of OSHA (Occupational safety and health administration – US Occupational Safety Administration) and EPA (Environmental Protection Agency – US Environmental Protection Agency) for the procurement, processing, transportation and disposal of asbestos-containing materials,

– Mandatory involvement of qualified specialists to check the location and condition of asbestos-containing materials,

– A particular example: The prohibition of the purchase of asbestos-containing products for construction, reconstruction and repair projects of the US Administration.

– Information on the procurement of utilities and conditions of special financing of utilities related to energy saving projects;

– Information on purchases of natural gas and electricity in unregulated markets;

– Analytical data on energy use;

– Providing protection for projects involving renewable energy.

– negotiations on the best transport rate with local gas suppliers;

– administration of energy procurement;

– checking invoices from local gas distribution companies and gas suppliers;

– Dissemination of information on energy – Energy Awareness.

– Energy efficiency;

– Alternative project financing;

– Special conditions in utility contracts;

– Purchase of green energy;

– Course intervention;

– Control of the supply of utilities;

– Energy policy.

– Availability;

– Biological assessment;

– Endangered species;

– Coastal zone management;

– Environmental assessment and environmental impact factors;

– Ecological value;

– Floodplains and wetlands;

– Noise pollution.

Hazardous materials – Hazardous materials.

The handling of hazardous materials is regulated by the US Environmental Protection Agency (EPA), the US Occupational Safety and Health Administration (OSHA), the US Department of Transportation (DOT) and the US Nuclear Regulatory Commission (NRC). Below are some examples of hazardous waste management requirements:

Pesticides are toxic pollutants. Pesticide control programs are concerned with reducing exposure to these chemicals or using the least toxic alternatives. The purpose of the programs is to reduce the risks of health effects, difficulties in operation or damage to real estate. The requirements for the management of pesticides for federal property apply to more than 70 federal agencies, two foreign governments and about 50 government agencies in 17 states (the requirements are presented in paragraphs 136r-1 of section 7 of the United States Code and section 41 of the Code of Federal Regulations (102-74.35)

The goal of the GSA Solid Waste Management program is the recycling and reuse of solid waste. The target indicator is fixed for different years. In order to minimize waste, a Green Procurement Plan has been introduced, the requirement of which is the availability of a bio-base, the choice of non-ozone-depleting, energy-efficient, water-efficient goods, the content of recycled material, non-toxic components or less toxic alternatives.

The Office of the Administration of the United States of America conducted an analysis of version 4 of the voluntary LEED green building certification system for buildings. The main conclusion was that, despite the lack of direct correspondence between LEEDv4 requirements and federal requirements, LEED requirements are close to the requirements of the federal level for sustainable development and green building. Incorporating LEED recommendations helps accelerate federal and private sector adoption of the best and leading green building strategies. The Office of Administration’s LEED Analysis Report is publicly available and can be found here https://www.gsa.gov/cdnstatic/Green_Building_Certification_System_Supplemental_Review_of_USGBCs_LEED_v4.pdf

Many federal agencies use LEED as a tool for evaluating and reporting their facilities. For example, the LEED Gold-certified US Treasury building saves more than $1 million to US taxpayers annually through smart and integrated strategies to reduce energy and water use (https://www.usgbc.org/articles/changing-face-green-buildings-iconic-treasury-building-earns-leed-gold-0).

The Ministry of Infrastructure and Water Resources, together with the Dutch Ministry of Finance, have developed programs to reduce depreciation and receive tax incentives on investments for projects that prove their sustainability. The purpose of the programs is to encourage investment in environmentally friendly assets.

With the Netherlands’ annual budget for 2018 of €277 billion, the following amounts are allocated to each of the programmes:

When a budget overrun occurs, the finance minister can restrict one or both programs, but this has not happened since 2008. Under these programs, the unused budget for one year can go to the next year.

In order to determine how environmentally friendly an asset is to be invested in, an Environmental List has been prepared and is updated annually. The list includes a list of criteria for classifying projects as projects of reduced environmental impact.

To receive incentives for investments made in 2018, the Environment List 2018 applies. In this list, projects are divided into the following groups:

Example 1: Using Vamil

You buy equipment worth 50,000 euros, which has a life of 10 years before full depreciation. Under “normal” depreciation, the book value of the equipment is reduced annually in equal installments, reducing taxable income. The annual depreciation is determined as the cost less the depreciated part divided by the remaining useful life, i.e. EUR 5,000 per year, for the first year (defined as EUR 50,000 – EUR 0) /10.

Since this asset is on the Eco List, Vamil can be applied. This means that you determine the depreciation period yourself. Even in the year of the investment, you can charge 75% of the total cost of 50,000 euros, i.e. 37,500 euros. This amount can be taken into account in determining profit (provided that the asset has been used or the funds have been paid). Thus, reduced profits lead to a decrease in the taxable base and, as a result, lower taxes. The net benefit depends, among other things, on the depreciation of the purchased equipment and the interest rate at which the financing is raised.

Example 2: Attracting investments in projects that reduce the negative impact on the environment (MIA)

Assume that taxable income is €75,000 after regular depreciation. Income tax – 20%. You invest 50,000 euros in assets.

To determine the amount of reduction in the taxable base, it is necessary to determine the category of environmental friendliness. There are the following codes for classifying equipment as environmental categories:

Suppose the purchased equipment is included in the Environmental List with code D.

The deduction for code D is 27% of EUR 50,000, i.e. EUR 13,500. Thus, taxable income is recalculated to 61,500 euros (75,000 euros – 13,500 euros). Without the application of MIA benefits, a tax of 15,000 euros (20% of 75,000 euros) must be paid. When using MIA, the tax is 12,300 euros. In total, the direct tax benefit is 2,700 euros.

Example 3: Combination of MIA and Vamil

You have acquired a business asset that is on the Environmental List. The environmental category starts with code B. The purchase price is 50,000 euros with a full depreciation period of 5 years. You can use both MIA and Vamil scheme.

The amount of the deduction for category with code B is 13.5%, i.e. the reduction in the MIA tax base will be 13.5% of 50,000 euros, namely 6,750 euros.

Under “normal” depreciation, €10,000 can be deducted from taxable income every year for 5 years. Since Vamil can also be applied to a business asset, it is allowed to depreciate 75% of the invested amount in the first year. In this case, the depreciation charge for the first year would be EUR 37,500. In this case, the base for taxable income will be 50,000 euros – 37,500 euros = 12,500 euros. For the next 4 years, only 25% will remain for depreciation.

€12,500 can be reduced by €6,750 subject to the applied Vami program. Those. income tax in the first year will be 20% of 5,750 euros.

You can get acquainted with other programs on financial mechanisms for sustainable development projects on the website https://mijn.rvo.nl.

The Stroomversnelling Association is made up of contractors, component suppliers, housing providers, local governments, financial institutions, property management companies and other parties. The association’s primary goal is to reduce the cost of new home renovations, increase occupant acceptance of upgrades, and accelerate the growth of energy-reduced housing.

The association was born out of a previously government-funded Dutch innovation program called Energiesprong, which aimed to create Net Zero Energy (NZE) buildings on a large scale. In 2013, the Stroomversnelling agreement was concluded between Dutch building contractors and housing associations for the renovation of 111,000 houses. Two years later, Stroomversnelling became Energiesprong’s market-driven initiative to take zero-energy building construction to the next level. The renovation of existing buildings under this program comes with a 30-year performance guarantee for both indoor climate and energy performance. Thus, money normally used to pay energy and maintenance bills is channeled into upgrades. That is, residents receive an updated, warm and comfortable home with reduced operating costs.

The Energiesprong team works with government officials to organize government funding. The mission of Energiesprong International is to extend this approach to other markets.

Currently, the participants of the program are France, Great Britain, Germany, the state of New York and not only.

Source: https://energiesprong.org/

In the Netherlands, 1,300 Net Zero Energy retrofit projects have been completed so far and another 500 homes are under construction. You can read about the projects at http://stroomversnelling.nl/projecten/.

Another 15,000 new buildings/refurbishments are planned. Over the past years, twelve vendors have developed and improved practical NZE concepts for multi-family buildings, and the first NZE concepts for multi-family buildings over 5 stories are being completed. High-rise buildings remain a problem, partly due to the limited roof surface in such houses. The limited space makes it impossible to place enough solar panels on the roof to provide all apartments with enough electricity for heating, hot water and household appliances. Therefore, for such buildings, innovation is still needed.

Innovative partners capable of operating at industrial scale are also needed to reduce refurbishment costs and improve quality. One of the innovative partners in the Netherlands is Factory Zero, a start-up and incubator created by the NWE interreg project. The plant works closely with innovative players in the building materials industry to develop, manufacture and supply complete Net Zero Energy systems.

Financing:

Energiesprong NL / Stroomversnelling receives support from:

In the Netherlands, buildings are certified to the BREEAM voluntary green building standard through a local operator. BREEAM charts are used, adapted to the local market and translated into Dutch. The local operator Dutch Green Building Council is actively working to promote sustainable development ideas. Over the years, several innovative projects have evolved into full-fledged products:

Dutch Green Building Scanner

Based on the BREEAM NL In-Use 2016 version of the assessment method, you can quickly get an idea of the sustainable performance of the building (https://www.greenbuildingscan.nl/). The scanner evaluates the building on more than nine different sustainability topics, incl. health, energy and use of materials. The results provide a rough estimate that can be used to reduce building operating costs and improve sustainability performance.

The results of the assessment with indicators of sustainability are accepted by some international banks for discussion of financing conditions (https://www.ingref.nl/nl/ing-ref-duurzaam/ing-ref-sustainable-finance).

Valuable school

In 2015, the Dutch Green Building Council, together with a number of DGBC members, launched a social project called “Valuable School”. The project has created a toolkit to improve primary schools and make them more sustainable. Sustainable building, management, behavior and space for education are the main components of the “Value School”.

Source: implemented project “Valuable School” https://www.waardevolleschool.nl/

BREEAM Junior

The Dutch Green Building Council has developed a BREEAM-NL based curriculum specifically for primary and secondary education students. By using BREEAM-NL Medior и BREEAM-NL Junior students can evaluate their own school opportunities against sustainability indicators.

The Netherlands, like many other European countries, has a developed green bond market. For example, the Dutch asset management company PGGM (asset under management – 215 billion euros) invested 10 million euros in green bonds issued by the Dutch airport operator Royal Schiphol Group, in addition, the pension fund PFZW (assets under management – 206 billion .euro) jointly with other clients invested 500 million euros. Thus, the state transport group has raised funds to ensure its energy neutrality by 2040 (https://www.ipe.com/news/esg/esg-roundup-pggm-backs-airport-groups-green-bond/www.ipe.com/news/esg/esg-roundup-pggm-backs-airport-groups-green-bond/10027416.fullarticle)

On March 26, 2018, the UK Department of Justice and the Environment published guidance on implementing the sustainable development goals for the Department’s facilities. Work is being carried out in the following areas:

The key document in shaping the goals of sustainable and energy efficient management is the Climate Change Act 2008 (The Climate Change Act 2008). It sets as the target level of reduction of CO2 emissions an 80% reduction in emissions by 2050 compared to 1990. By years, the reduction targets are fixed as follows:

Goals have been set to reduce environmental impact by 2020:

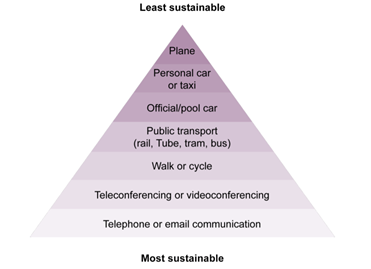

Recommendations have been developed on the types of transport used, and an example of an action is – reducing the number of flights within the country by at least 30% compared to the baseline of 2009-2010.

In accordance with the guidance of the UK Department of Justice, all construction and renovation projects carried out by the Department of Justice, as well as the Directorate of Property Management on behalf of the Property Management Unit of the Department of Justice, must apply Public Procurement Standards (GBS) to ensure the principles of sustainable development in the design and construction.

Sustainable building and refurbishment is primarily achieved through the application of the BREEAM building assessment method, which helps create more sustainable properties with lower operating costs.

The government website presents the main requirements, according to which, all properties worth more than £500,000 must comply with the requirements:

A more precise description of points 3-8 can be found on the website

Both market-based instruments and tax diversification and mandatory legal requirements for organizations are used as incentive tools for reducing the negative impact on the environment and sustainable development in the UK (https://www.gov.uk/guidance/pay-environmental-taxes).

There are 2 types of billing:

Basic rates:

Example of basic tariffs (https://www.gov.uk/government/publications/rates-and-allowances-climate-change-levy/climate-change-levy-rates)

CPS carbon price maintenance tariffs: determined over a 3-year period and calculated by multiplying the fuel emission factor and the difference between the target government carbon rate and the market rate. CCA). The participants in such agreements implement solutions to reduce the environmental impact in their activities. Participants in energy-intensive industries can conclude agreements on climate change (https://www.envantage.co.uk/carbon-management/climate-change-levy-agreement/sectors-with-climate-change-agreements.html).

The tax is charged by weight, there are 2 rates. Inert or inactive waste – at a lower rate

– trade with other enterprises;

– buying or selling from intermediaries, such as banks and specialized traders;

– using the services of a broker;

– joining one of several exchanges that trade emissions allowances;

– trading on the sites of the UK government or other EU member states.

An example of reflecting information on the purchase of quotas: “Emission quotas have been purchased that offset greenhouse gas emissions by 5,000 tons. Quotas are Kyoto-compliant Certified Emission Reductions (CERs) and comply with the Clean Development Mechanism (CDM). Quotas provided by Carbon Offsetting Ltd. and refer to Project 0939: Yutai Hydroelectric Project.”

The scheme is used in large non-energy intensive enterprises (supermarkets, hotels, water companies, banks, government organizations, including schools, government departments).

The procedure consists of several steps:

4.1 Creating an account on the portal CRC Energy Efficiency Scheme https://www.gov.uk/guidance/crc-energy-efficiency-scheme-qualification-and-registration)

Companies are required to register for the CRC if two conditions are met:

4.2 Monitoring and reporting CO2 emissions from gas and electricity use

First year allowance for the asset being acquired (full pre-tax profit may be deducted). Such assets include energy and water efficient equipment:

Japan’s need to reduce energy consumption is very high. It is linked to both the oil crises of 1970 and the great earthquake of 2011, which caused rolling blackouts (switching off to reduce consumption) and setting limits on peak loads. The Japan Energy Conservation Center was established in 1978, and in 1979 a law on energy conservation was adopted.

In accordance with the law on energy saving, there are energy consumption standards for different sectors of the economy, all enterprises annually prepare reports on measures taken in order not to exceed the planned volume of energy consumption. The government’s requirement is to reduce electricity consumption by 1% annually by increasing energy efficiency.

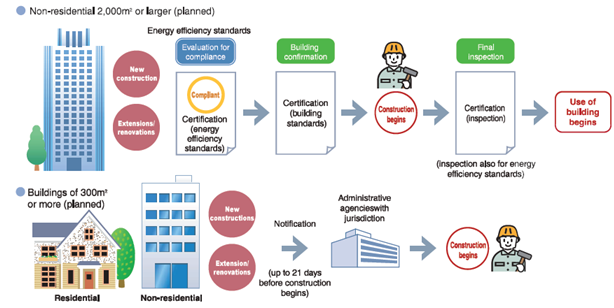

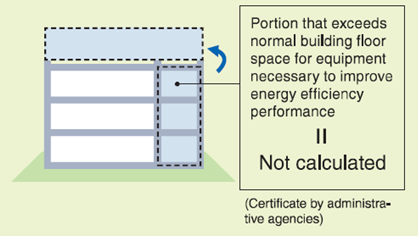

In 2015, the Energy Efficiency in Buildings Act was promulgated. In accordance with article 7 of the Act, organizations whose activities are related to the sale and rental of buildings must develop measures to improve the energy efficiency of facilities. The act prescribes:

Japan’s current goal is to reduce electricity consumption by 13 percent by 2030, which would require building energy efficiency improvements by 35 percent.

There is a program of the Ministry of Economy, Trade and Industry “Reducing the tax on green investments”. The program was adopted in 2012 after the termination of the earlier energy efficiency programs. Under this program, organizations that purchased equipment during the period April 1, 2013 through March 31, 2016 are eligible for special depreciation of 30% of standard purchase prices or a 7% tax deduction (SMEs only). Business operators who purchase equipment that is covered by both the tax reduction and the energy tax reform scheme may choose either of the tax systems that will apply to said equipment, but cannot take advantage of both systems.

Equipment that meets the requirements of the programs:

The Energy Conservation, Renewable Energy, Natural Resources and Energy Department of the Ministry of Economy, Trade and Industry provides grants for energy efficiency projects. The total budget is about 7 billion Japanese yen, which corresponds to 61 million US dollars. (https://www.iea.org/beep/japan/incentives/subsidy-for-promotion-program-of-high-efficiency-energy-system-to-residential-an.html, https://www.eu-japan.eu/sites/eu-japan.eu/files/ITO.pdf).

Grants are issued in the following areas:

Financial support is provided for half of the cost of technologies that reduce CO2 emissions.

The financial support is provided for half of the value added associated with zero energy technology organizations. The maximum subsidy for 1 house is 165 million JPY.

Financial support is provided for 1/3 of the costs associated with the organization of measures to reduce energy consumption. Grants for barrier-free environment measures are only made in conjunction with energy efficient solutions. The maximum subsidy for 1 house is 50 million yen (with the introduction of energy-efficient measures in combination with barrier-free solutions – 75 million yen per house).

Financial support is provided for 1/3 of the costs associated with increasing the life of the object. The maximum grant per building is 1 million JPY.

The Japanese government believes that the construction of buildings with zero energy consumption (Zero Energy Buildings (ZEB) and Zero Energy House (ZEH)) is a key solution for energy saving. Zero energy consumption is achieved by a combination of energy production technologies, including the use of renewable energy sources, and the use of energy efficient solutions for the energy consumed.

National government policy documents such as the 2011 Energy Savings Strategy and the 2014 Energy Plan identify such buildings as driving technologies for energy savings in the residential and commercial real estate sectors. The Department of Natural Resources allocates a significant amount of budgetary funds in the form of grants for promotional projects to promote energy saving technologies, which are necessary for the implementation of zero-energy buildings.

The following targets are set in the Energy Efficiency Baseline 2014:

To achieve the above goals, the government issued a roadmap in December 2015.

In 2016, the Ministry of Economy, Trade and Industry started to establish the “Registration System for Zero Energy Building Developers”. They may receive a grant to build such a building, but must comply with certain obligations listed below:

State subsidies are granted when buildings meet the definitions of ZEB and ZEH at the design stage. The roadmap also introduced the concepts of Nearly ZEB and ZEH and Ready ZEB:

Note: Clean energy includes energy from renewable energy sources.

Amount and rate of subsidies: 1.25 million JPY per building (varies by year and depending on the total allocated budget for such subsidies. For example, in 2016, the total budget was 11 billion JPY), ranging from 1/3 to 2/ 3 of the total cost of high performance solutions and thermal insulation materials installed to achieve ZEH/ZEB.

In Japan, as in many other rapidly developing countries, the issues of promoting sustainable development and energy efficient construction are entering the level of urban planning. In September 2018, the Tokyo City Sustainability Strategy was released, in which the City Government set out clear indicators and activities for implementation in the city until 2020 and 2030.

The objectives are summarized as follows:

– Introduction of LED lighting for 100% of the city’s infrastructure solutions,

– Decrease in the use of plastic bags (eliminate the provision of plastic bags for free),

– Reducing greenhouse gas emissions by 30% compared to the level of 2000 (in 2016 there is an increase of 6.1%);

– Reducing energy consumption by 38% compared to the level of 2000 (in 2016 there is a reduction of 20.8%);

– Use of renewable energy sources for generated electricity – 30% compared to the base year 2000 (by 2016 12.1%);

– Use of hydrogen energy (200,000 cars with hydrogen fuel);

– Increasing the level of urban waste recycling up to 37% (23% by 2016);

– Reducing the volume of generated waste – achieving 25% compared to the level of 2012 (in 2015 – 21%);

– Increased participation in the city’s sustainable development programs – up to 58,000 people (12,400 in 2014-2017);

– Reaching the concentration of photochemical oxidant below 0.007 ppm (for all monitoring stations).

China’s energy policy is a step-by-step implementation of the set goals to reduce energy consumption. Building codes require a gradual increase in the energy efficiency of a building, from 30% to 50% and up to a 65% reduction in energy consumption compared to the baseline set back in the 1980s. The requirements of some cities and towns are even more stringent and aim to reduce energy consumption by 75%.

Beijing, the capital of China, hosted the 29th Summer Olympic Games in 2008. For the design and construction of Olympic venues, the first detailed green building assessment system was launched in 2002. Since then, China has continuously improved its green building standards system and set energy saving targets.

China’s first national standard for evaluating buildings for green building criteria was launched in 2006 (GB/T 50378 2006). The standard was updated in 2014. Currently, there are more than 10 green building standards officially issued by China’s Ministry of Construction and Urban Development (MOHURD). The standards cover the stages of design, construction, operation and modernization. Environmental design and construction standards are created for various facilities – industrial, office, residential buildings, data centers, hospitals, shops, restaurants, exhibition sites, reconstruction of existing buildings, campuses, cities.

Green building standard MOHURD is represented by a three-rating system – one, two, three stars (3 stars for getting 80 points out of 100). During certification, the “Green Building Evaluation Label” – GBEL is assigned. The certificate is valid for 3 years.

The score is based on the following seven indicators:

Number of buildings certified according to the standard GBEL, began to grow steadily after a strong incentive system was introduced – at the national and regional levels – for example, the provision of subsidies and lower income tax rates.

For example, the Chinese government recognized the efforts of major building materials manufacturer China Advanced Construction Materials Group to use construction waste to produce recycled concrete by granting a 6% VAT reduction and a 5% reduction in high-tech corporate income tax for recyclable materials. The Chinese government supports the use of fillers derived from construction waste in government projects.

At the regional level, tiered financial incentive systems are applied for buildings certified to 2 or 3 stars.

The Green Building Action Plan requires that public buildings such as schools, hospitals, museums, stadiums and social housing and other facilities with a building area of more than 20,000 square meters (airports, train stations, hotels, restaurants, shopping malls, offices and other ) they met the quality standards of the GBEL rating system.

стандартам качества рейтинговой системы GBEL.

The state certification initiative is moving to the municipal level. Local authorities set more stringent requirements for green certification. The implementation of such decisions is also the responsibility of the local administration.

LEED, being a global brand, has been actively introduced in China since 2005. It is the preferred standard, especially for commercial buildings. According to research of CBRE ,the average occupancy of LEED premium projects in China is 10% higher and rents are 25% higher compared to non-certified buildings.

Source: https://china.lbl.gov/sites/all/files/green_buildings_policy_comparison.pdf

Significant progress was made in promoting green building in 2013. On January 1, 2013, the green building development plan was released. The plan was developed by the Ministry of Housing and Urban Development of China and released by the General Office of the State Council of China. Since then, 31 provinces have released their green building action plans.

A revised edition was released in 2014 and officially became effective on January 1, 2015.

In 2015, China’s total energy consumption was 857 million tons of coal, which corresponds to 20% of China’s total energy consumption, based on statistical studies released by China’s Energy Efficiency Association in buildings in November 2017. Realizing the sustainable development goals and reducing the energy consumption of buildings is one of the priorities of the Chinese government.

In the 13th Five-Year Energy Efficiency and Green Building Development Plan released by China’s Ministry of Construction and Urban Development in February 2017, China set clear targets to achieve green building development by 2020.

The objectives of the plan are:

More than 10 provinces in China, including Beijing, Hebei, Shandong, Fujian, Qinghai, Hunan, Jiangsu, Liaoning, Inner Mongolian, Heilongjiang and Sichuan, have established an “Action Plan” to accelerate the development of the Nearly Zero Energy Building (NZEB). Local authorities apply financial incentives for the development of low energy buildings. For example, in Beijing, NZEB projects will receive a subsidy of 600 to 1,000 CNY per square meter of NZEB buildings. By the end of 2018, Beijing must have at least 300,000 square meters of low-energy buildings. At least one NZEB demonstration project must be presented in each administrative region of Beijing. Realizing the goals of ultra-low energy consumption applies not only to residential buildings, but also to commercial facilities, industrial parks and various thematic projects.

Following the adoption of the 11th Five-Year Plan, the Ministry of Housing and Urban Development of China launched a pilot eco-city program to promote urban resilience. In 2010 year China’s National Development Reform Commission launched a low-carbon city indexing program. During the 12th Five-Year Plan, the pilot program brought together 36 cities and six provinces. These cities evaluate energy use and greenhouse gas emissions, set targets, develop action plans to reduce carbon emissions, develop local standards and incentives that go beyond national requirements. In early 2017, the pilot cities program was expanded to include 45 more cities.

Tighter air pollution control measures were announced in 2012 as part of the 12th Five-Year Plan (MEP et al., 2012). In 2013, the State Council published data on the implementation of measures to prevent air pollution, and a network of 500 PM2.5 monitors was established in 70 cities in China. In March 2014, the State Council issued a new National Urbanization Plan 2014-2020, which set targets for urban infrastructure and urban socio-economic development. As a confirmation of China’s international intentions, in 2015, 21 Chinese cities joined the Alliance of Peaking Pioneer Cities, promising to reduce the peak of energy generation-related CO2 emissions by 2030.

The City Indexing Program is being used as a tool to track annual progress in developing green, low-carbon products during the 13th Five-Year Plan (2016 to 2020). Indexing results can be used by local governments to identify areas for improvement and prioritize and implement low-carbon strategies at the local level.

Active urbanization has led to the creation of smart cities in China. The 13th Five-Year Plan confirms that the country is committed to optimizing urban space through public transport, high-capacity infrastructure, mixed-use development and green city planning. This stimulates the development of a smart city using the latest low-carbon and energy-efficient technologies. The National Development Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the Ministry of Finance, the Ministry of Natural Resources, the Ministry of Construction and Urban Development, and the Ministry of Transport, in support of national goals, prepared the “Guidelines for Promoting the Healthy Development of Smart Cities” in 2014. According to this Guide, Smart City is developing in 10 directions: Smart Transport, Smart Power Grid, Smart Water Distribution, Smart Environmental Protection, Health Protection, Retirement, Health Protection, Community, Household, Education and Land Resources.

At present, relevant state and municipal departments in China are actively promoting the development of smart cities. Investment in Chinese smart cities is expected to exceed 1.6 trillion yuan in the coming years.

Ministries seek to sponsor programs and industry alliances. In 2012, the Ministry of Science and Technology organized the China Smart Urban Innovation Strategic Alliance. In 2013, sponsored the China Smart City Industry Alliance group, and in 2017 announced a 250 billion yuan (8 billion USD) investment in smart city research and projects. In the spring of 2017, the National Development Reform Commission formed the Smart City Development Alliance. Some companies work with only one of these new groups, and some participate in all three. The groups are designed to improve communication between industry participants, communication between industry and government, China Smart City Industry Alliance to coordinate investment.

In January 2013, the Ministry of Construction and Urban Development officially announced the first list of national Smart Cities pilot companies. By April 2015, there were over 285 pilot smart cities in China, as well as 41 special pilot projects.

In addition to strictly regulated norms for ensuring the thermal insulation of real estate objects, developed back in the days of the Soviet Union, now in Russia a lot of attention is paid to sustainable development issues: the normative theoretical base is noticeably expanding, measures are being introduced that support the development of energy-efficient solutions, there are state programs to create a comfortable urban environment and introduction of modern information technologies in urban infrastructure.

Russified international standards for sustainable development.

In the Russian Federation, there are several standards for sustainable development, which are translations of inter-shock standards:

Sustainability and Green Investment

The National Association of Concessionaires and Long-term Investors has developed recommendations in the field of sustainable development and green investment.

National Association lists the following as the most significant sustainable development and green investment projects and initiatives: International Coalition for Environmentally Responsible Economy (Ceres); International Chamber of Commerce’s Business Charter for Sustainable Development; Global Reporting Initiative (GRI); the United Nations Global Compact; Equator Principles and others. The NACDI Recommendations reveal the main content and features of the implementation of these initiatives.

Green standards approved by Rosstandart

– Attribution criteria”;

– Assessment of compliance with the requirements of green standards. General Provisions”.

There is a Decree of the Government of the Russian Federation of June 17, 2015 N 600 “On approval of the list of objects and technologies that relate to objects and technologies of high energy efficiency.” In accordance with it, objects with high energy efficiency include waste heat boilers, solar collectors, heat pumps, gas turbines, solar panels, etc. Goods for which it is mandatory to determine the energy efficiency class are refrigerators and freezers, washing machines , domestic air conditioners, dishwashers, TVs, ovens and others.

As for real estate, according to Article 12 of the Federal Law 261-FZ of November 23, 2009 “On Energy Saving and Increasing Energy Efficiency”, the energy efficiency class is determined only in relation to apartment buildings. For other buildings, structures, structures, the energy efficiency class can be established by the decision of the developer or owner. The rules for establishing requirements for the energy efficiency of apartment buildings are presented in Decree of the Government of the Russian Federation of 01.25.2011 N 18 (last changes from 01.01.2018). On June 6, 2016, the Ministry of Construction of Russia signed Order No. 399/pr ” On Approval of the Rules for Determining the Energy Efficiency Class of Apartment Buildings.” The document approved the basic levels of the specific annual consumption of energy resources in residential buildings.

The energy efficiency class is indicated by letters (the highest is A ++, the lowest is G). The energy saving classes of public and residential buildings are determined in accordance with SP 50.13330.2012 Thermal protection of buildings.

During commissioning, the energy efficiency class is determined by the State Construction Supervision Authority on the basis of the Energy Passport (The justification for the need to conduct an energy audit and prepare an energy pass is prescribed in Federal Law 261, Chapter 4, Article 15:). For operated buildings, the energy efficiency class is assigned by the State Housing Inspection on the basis of the Energy Declaration.

– research or development work;

– technical re-equipment of own production, aimed, among other things, at improving the energy efficiency of the production of goods, performance of work, provision of services and / or measures to reduce the negative impact on the environment, provided for by the Federal Law of January 10, 2002 N 7-FZ “On Environmental Protection “”;

– making investments in the creation of facilities with the highest energy efficiency class, including apartment buildings, and (or) related to renewable energy sources, and (or) related to facilities for the production of thermal energy, electric energy, with an efficiency of more than 57 percent, and (or) other objects, technologies with high energy efficiency, in accordance with the list approved by the Government of the Russian Federation.

Increasing the coefficient by 2 times gives an increase in depreciation by 2 times, which leads to a decrease in income tax.

The departmental project of the Ministry of Construction of Russia “Smart City” was approved by order of the Minister of Construction, Housing and Communal Services of the Russian Federation on October 31, 2018.

The goals of the project are to translate information in the areas of housing and communal services, landscaping, urban planning and architecture into a machine-readable form, create digital tools for the participation of residents in decision-making on urban development issues, increase the share of management companies and resource supply enterprises using automated dispatching systems, increase the number of apartment buildings connected to automated accounting systems for utility resources (http://www.minstroyrf.ru/press/utverzhden-pasport-vedomstvennogo-proekta-umnyy-gorod/).

On March 4, 2019, Andrey Chibis, Deputy Minister of Construction, Housing and Communal Services of the Russian Federation, head of the Smart City project, approved the Smart City standard. The standard includes a set of basic and additional measures to be carried out by all cities participating in the departmental project of urban digitalization “Smart City” until 2024 (http://www.minstroyrf.ru/press/v-rossii-poyavilsya-standart-umnogo-goroda/).

The standard includes activities in eight areas: urban management, “smart” housing and communal services, innovations for the urban environment, “smart” urban transport, intelligent systems for public and environmental safety, communication network infrastructure, tourism and services.

Thus, the first step will be the introduction of digital platforms and services to involve citizens in the management of urban processes, which should be launched in every region of the country as early as 2020.

The high level of equipment with building automation and the intelligent management of urban infrastructure will reduce energy consumption and promptly eliminate shortcomings in the operation of engineering systems.

The program to stimulate a comfortable urban environment was launched by Decree of the Government of the Russian Federation No. 169 dated February 10, 2017.

The main goal is to create conditions for a systematic improvement in the quality and comfort of the urban environment throughout the Russian Federation by implementing annually (in the period from 2017 to 2020) a set of priority measures to create a modern comfortable urban environment in the constituent entities of the Russian Federation, by 2020 implementing 400 comprehensive beautification and training projects for 2,000 specialists (http://www.minstroyrf.ru/trades/gorodskaya-sreda/strategicheskoe-napravlenie-razvitiya-zhkkh-i-gorodskaya-sreda/). It is assumed that the main part of the entire budget of the program will be allocated from the federal treasury, the remaining part of the costs will be covered by the regions themselves.

The document distributes priorities within cities. In particular, it is assumed that two thirds of the allocated subsidies are transferred to the development of yard areas, one third – to parks, squares, pedestrian zones, etc.

In accordance with Federal Law No. 89-FZ, wastes are divided into 5 classes depending on the degree of negative impact on the environment. Decree No. 524 of August 26, 2006 regulates the handling (collection, use, neutralization, transportation, disposal of waste) of hazardous waste (I-VI classes), which must be licensed. Updates are regularly made to Federal Law No. 89, the latest edition is dated 07/29/2018. Article 24.6 describes a new concept – a regional municipal solid waste operator – an organization that is responsible for the entire life cycle of waste from a container to a landfill.

Decree of the Government of the Russian Federation dated July 25, 2017 No. 1589-r approved a list of types of production and consumption waste, which include useful components, the disposal of which is prohibited – such waste can be recycled or reused. The entry into force of the order is carried out in stages by type of waste: from January 01, 2018, 2019, 2021.

In August 2018, Resource Saving KhMAO LLC (Concessionaire implementing projects for the creation and operation of municipal solid waste (MSW) management systems in the Russian Federation, in the Khanty-Mansiysk Autonomous Okrug – Yugra (KhMAO)) joined the initiative of the National Association of Concessionaires and Long-term Investors (NACDI) in the field of sustainable development and green investment. On December 19, 2018, Resource Saving KhMAO LLC placed information on the issue of green bonds on the Moscow Exchange. The company became the first issuer of green bonds in Russia based on the Green Bond Principle ICMA and received a second opinion from the European rating agency Rating-Agentur Expert RA GmbH (http://rsb-hmao.ru/ ).

The purpose of the issue is the implementation of the construction and operation in the Nefteyugansk region of an integrated inter-municipal landfill for the placement, neutralization and processing of municipal solid waste. The capacity of processed waste will be 100,000 tons per year. 100% of incoming garbage will be processed with the extraction of all useful fractions. Metal, plastic, paper, cardboard will be used in the production of secondary products. The facility will operate for at least 20 years.

The number of bonds is 1,100,000 pieces with a par value of 1,000 rubles each. The bonds mature on June 17, 2031, the initial coupon rate is 10%.

The Ministry of Industry and Trade of the Russian Federation is developing state support mechanisms – in particular, in 2019, Russia will launch a mechanism for subsidizing green bonds, which provides for compensation of 0.7% of the base coupon rate. The Ministry of Industry and Trade of Russia allocated about 9.3 billion rubles for these purposes for a three-year period (https://investinfra.ru/novosti/minpromtorg-rossii-v-2019-godu-vnedrit-mehanizm-subsidirovaniya-obligaciy-pod-realizaciyu-zelenyh-proektov.html). A specialized sector of green bonds is planned to be created on the Moscow Exchange in 2019.